unlevered free cash flow yield

In year 10 the large cash flow represents the income from operations plus the proceeds from the sale of the property the reversion cash flow. Putting this all together the formula has been shown below.

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free cash flow yield is a ratio wherein a FCF metric is the numerator and the total number of shares outstanding is the denominator.

. 1 0 Y A F C F O S O W P S P L C A I where. LFCF yield is calculated as levered free cash flow divided by the value of equity. To break it down free cash flow yield is determined first by using a companys cash flow statement Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period subtracting capital expenditures from all cash flow.

Free cash flow shouldnt be confused with working capital which involves a calculation of all cash assets and liabilities. Free cash flow yield is really just the companys free cash flow divided by its market value. A negative free cash flow yield or negative free cash flow may indicate that the firm is not liquid enough and would need external funding to continue its operations.

If you own or operate a business cash flow is the means by which your business covers expenses. A lower free cash flow yield is worse because that means there is less cash available. As you can see in the example above and the section highlighted in gold EBIT of 6800 less taxes of 1360 without deducting interest plus depreciation and amortization of 400 less an increase in non-cash working capital of 14000 less capital expenditures of 40400 results in unlevered free cash flow of -48560.

Intel annual free cash flow for 2020 was 20931B a 2362 increase from 2019. UFCF refers to unlevered free cash flow the final amount that you are aiming to prove. This is so impossibly elementary and yet there are literally dozens of.

Intel free cash flow for the twelve months ending December 31 2021 was a year-over-year. A lower free cash flow yield is worse because that means there is less cash available. Price per share - the current trading price of a share of a company or alternatively the total market cap.

CapEx and increases in NWC each represent outflows of cash which means less free cash flow remains post-operations for payments related to servicing interest debt amortization etc. Intel annual free cash flow for 2021 was 9662B a 5384 decline from 2020. Unlevered Free Cash Flow - UFCF.

Unlevered free cash flow can be reported in a companys. UFCF is calculated as operating cash flow minus capital expenditures. Unlevered free cash flow UFCF is a measure of a companys ability to generate cash flow from its operations after accounting for capital expenditures.

Free Cash Flow to Firm FCFF NOPAT DA Change in NWC CapEx. The cash flow of an organization is ordinarily classified as cash flows from different business operations financing and investing. Intel annual free cash flow for 2019 was 16932B a 1881 increase from 2018.

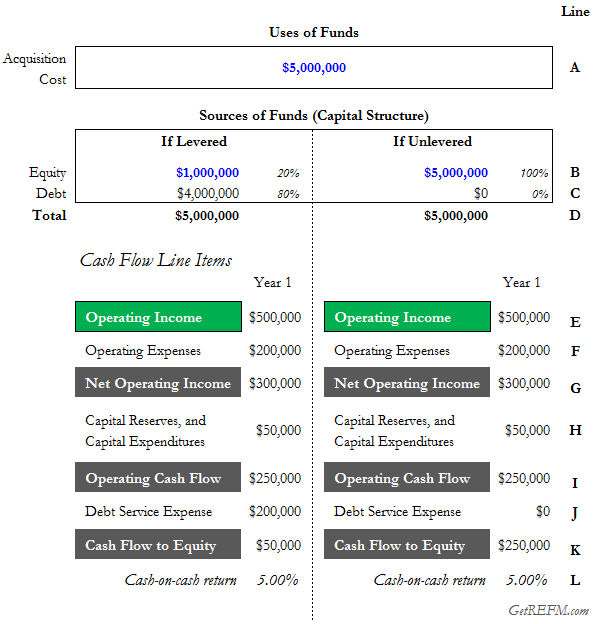

If the cash flow metric used as the numerator is unlevered free cash flow the corresponding valuation metric in the denominator is enterprise value TEV. Based on these projections the unleveraged IRR calculation is 989 and the cash-on-cash return averages 2062 but this is skewed higher by the sale of the property. Based on whether an unlevered or levered cash flow metric is used the free cash flow yield denotes how much cash flow that the represented investor groups are collectively entitled to.

A higher free cash flow yield is better because then the company is generating more cash and has more money to pay out dividends pay down debt and re-invest into the company. Secondly from a valuation standpoint you need to focus on UNLEVERED free cash flow. LFCF yield measures LFCF against the value of equity while UFCF yield measures UFCF against enterprise value.

There are a few techniques used to understand the cash flow of an organization including the debt service coverage. The continuous decline in free cash flow may impact future earnings growth. Free cash flow yield is meant to show investors how much free cash flow a company generates relative to the value of its sources of funds.

SP Globals latest twelve months unlevered free cash flow yield is 38. Definition of Unlevered Free Cash Flow Yield Free Cash Flow Yield UFCFY measures amount of free cash flow for each dollar of total enterprise value. Why is this you might ask.

View SP Global Incs Unlevered Free Cash Flow Yield trends charts and more. Cash flow per share - one of the various measures of cash flow including operating cash flow free cash flow variants on free cash flow and unlevered and levered free cash flow. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account.

This measure is unlevered meaning it does not take into account the companys debt burden. FCF yield is also known as Free Cash Flow per Share. Levered free cash flow includes operational costs while unlevered free cash flow provides a way to calculate without including expenses.

A company with debt will have a higher unlevered FCF yield than a levered FCF yield. Both cash flows illustrate the enterprise value of a particular company but one option levered may be more forthcoming when it comes to the true amount of debt. This appendix shows the two drivers used to calculate trailing FCF yield free cash flow and enterprise value for the SP 500 and each SP 500 sector going back to December 2004.

1 0 Y A F C F 1 0 -Year average free cash flow O S Outstanding shares O. The answer is among other things because a 10 levered FCF yield on the same company implies a massively different enterprise value if that company has 5x of debt versus zero debt.

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Explained

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator

Levered Vs Unlevered Free Cash Flow Difference Wall Street Oasis

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Ufcf Lumovest

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial